Content

Only be levied at 15 percent of payments under current law. Company owner may relocate overseas to avoid paying taxes. For student loan debt, Carter says you’ll have a wider range of options if you haven’t already defaulted. The National Consumer Law Center operates a website Social Security Benefits Eligible For The Federal Payment Levy Program that offers information and advice for those having trouble repaying student loans. Once you make an arrangement with the appropriate agency to repay your debt, the Social Security garnishment is released. In some cases, you may be able to negotiate a settlement.

The more difficult question is whether the IRS can reach the underlying assets which have been set aside to fund periodic retirement or pension payments. However, whether such funds are available to the IRS depends on the kind of plan involved, and whether such funds are available to the taxpayer. Finally, even if such assets are in theory available to the IRS, it is important to know when the Service will exercise its administrative discretion to forego taking levy action. State tax collectors cannot garnish federal benefits. States also cannot garnish ERISA protected pensions or other forms of retirement protected by state law.

What Is the Federal Payment Levy Program?

The agency may deduct the indebtedness from pay without the employee’s consent provided the deduction rate does not exceed 25 percent of the employee’s disposable pay (unless it is the employee’s final check). If you ignore the tax levy and do nothing, the IRS will continue to garnish your wages, levy your bank accounts, and seize your property until the entire liability is paid in full. Your client can also elect to have all the retroactive benefits counted in one tax year or be divided pro rata on a month by month basis across multiple tax years without amending returns from past years. Though this sounds appealing, if there is any other income in the household in past years, it is possible that your client will be paying more in taxes, even though less money is attributed to each year. If your client has any tax liability in the year s/he receives benefits, it is especially crucial consult a tax professional to figure out how to reduce taxes owed.

A common question with delinquent citizens is whether the IRS can levy social security benefits. The answer, unfortunately, is yes they can, and worse, they do so regularly. Before intercepting an SS payment, the IRS generally sends notice CP91, Final Notice Before Levy On Social Security Benefits. This letter informs you of the impending levy https://quick-bookkeeping.net/how-small-businesses-can-prepare-for-tax-season/ and invites you to call the IRS to set up payments if you cannot pay in full. Note that beneficiaries do have the right to appeal the accuracy of the debt, to offer a compromise lump sum, to request repayment at a slower rate, and to seek a hardship exemption. Debt collection activity should stop while the beneficiary seeks this relief.

Can My Social Security Be Garnished?

If you owe an overdue debt to a government agency, the agency sends information about your debt to our database. We send the money we withhold to the federal Office of Child-Support Enforcement, which is part of the Department of Health and Human Services . To find out about a specific payment, ask your state child-support enforcement office to contact HHS. The term “levy” as used in this title includes the power of distraint and seizure by any means.

- In addition to the original amount owed, you may be liable for penalties and interest.

- These can be made at any time electronically on the Thrift Savings Plan website.

- Re-employed annuitants in positions that convey FEHB eligibility and whose enrollment code has been transferred to the employing agency will automatically participate in premium conversion unless they waive participation.

- The first category involves Social Security beneficiaries who owe multiple debts to one or more Federal agencies and IRS.

- If you’re unable to work due to a disability and have bills piling up, Social Security Disability could provide much-needed relief.

Under no circumstances should you accept a payment for a debt owed to IRS. Post-offset claims (e.g., nonreceipt and nonentitlement) involving Title II payments that were levied are handled the same as non-offset payments. The beneficiary’s payment record is an SSA systems-generated record sent automatically to Fiscal Service; it is not the Master Beneficiary Record .

H. Procedure – Handling Inquiries about Tax Levy

By law, SSA does not have the authority to stop or delay IRS automated tax levy. Appeal the Social Security Garnishment or Levy — If you disagree with the Social Security levy, you should appeal. The final notice of intent to levy should outline your right to appeal.

- The payroll system calculates withholding by the percentage method.

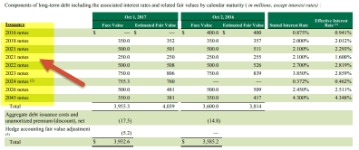

- Billion in unpaid federal taxes as of September 30, 2006.

- If you have three bank accounts at a bank, and your Social Security is deposited in account A, only this account is protected.

- Others may know the legal protections of retirement income and not consider what frequent debt collection efforts may do to the taxpayer with very limited income.

Employees in the CSRS and the FSRDS are not eligible for the agency automatic 1 percent contribution or the agency matching contributions. Resident aliens performing service in or outside the United States. Foreign Service and Civil Service retirement plans are not applicable to LE staff. LE staff employees hired after December 31, 1983 could not enroll in CSRS.

State e-File for business returns only available in CA, CT, MI, NY, VA, WI. Enrolled Agents do not provide legal representation; signed Power of Attorney required. Terms and conditions apply; seeAccurate Calculations Guaranteefor details. The IRS grants four types of penalty relief, but many taxpayers don’t ever ask.

- The Service can go after a portion of your paycheck, but you might be surprised to learn it can also go after Social Security benefits in retirement as part of itsasset seizure efforts.

- Of this number, nine states—Alaska, Florida, Nevada, New Hampshire, South Dakota, Tennessee, Texas, Washington, and Wyoming—do not collect state income tax, including on Social Security income.

- Fortunately, Social Security Back Pay can help you receive the disability payments you would have earned if you were approved earlier.

- If you owe the government, however, there is not the same level of protection.

- In the Washington, DC area with the three taxing entities Virginia, Maryland, and DC, the taxing entity is where the employee resides.

- Up to the full amount of payments to federal vendors.

- Top Tax Defenders has the knowledge of IRS policy and procedure, and can aggressively pursue a settlement for your tax debt.

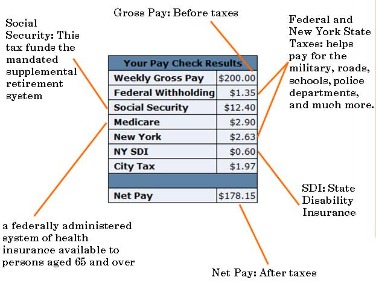

SSI is a monthly cash payment for low-income people who are disabled, blind, or over 65. Although the Social Security Administration administers the program, the benefits are not the same. Keep in mind, however, that the IRS can take any amount over the exempt amount. Say you receive Social Security payments for $1,600 per month. The IRS starts levying 15%, leaving you with $1,360 per month.

Get Help From Experienced Tax Professionals

In addition to the allotments specified in 4 FAH-3 H-548.2, employees may make general purpose allotments. The Department of State may pay lost earnings when authorized regardless of whether an employee submits a claim. Lost earnings must be addressed consistent with 5 CFR 1605. Consult 5 CFR 1605, Correction of Administrative Errors, for additional details of employee claims for lost earnings. An employee may present a claim for retroactive correction of an act or omission by the employing agency that was not in accordance with applicable statutes, regulations or administrative procedures.

If authorized, a completed Federal Tax Deposit Coupon should accompany payment to the Federal Reserve Banks to assure proper identification and posting. LE staff payroll offices pay the appropriate Federal Reserve Bank the U.S. dollar equivalent of contributions and deductions of LE staff/Permanent resident aliens and U.S. citizen employees hired abroad. Deductions are also reported annually on employees’ Form W-2, Wage and Tax Statement.

Applicants who applied for Social Security Disability Income and are approved based on their disability are eligible to receive Back Pay from Social Security. The IRS must send you a Final Notice of Intent to Levy and Notice of Your Right to a Hearing. The IRS sends this notice to your last known address 30 days before imposing a levy.